- The AI opportunity for insurers is huge, turbocharged by the explosion of data and the increasing maturity of AI techniques

- A critical stumbling block: the difficulty of convincing stakeholders about the accuracy, trustworthiness and relevance of AI model outputs.

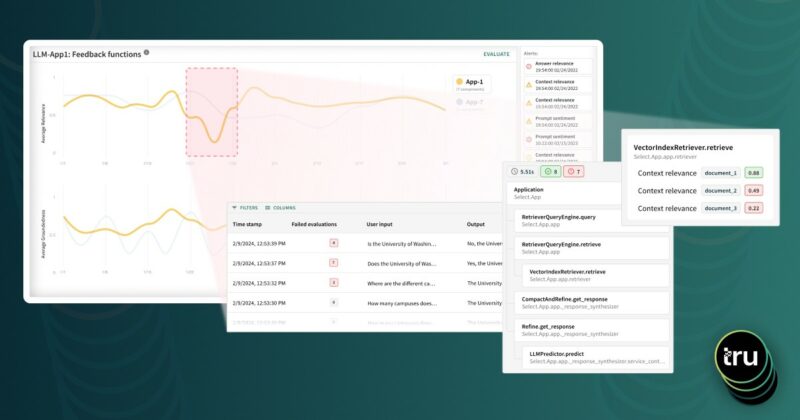

- AI Quality solutions increase trustworthiness by proving accuracy, explaining behavior, and demonstrating relevance and fairness.

Artificial Intelligence (“AI”) represents a transformational opportunity for insurers. Data and Analytics have always been central to the industry. The increasing maturity of AI techniques, and the explosion of data from new sources such as wearables and IoT devices, is turbo-charging that opportunity.

However, at many insurers, enthusiastic experimentation with AI has not yet translated into large-scale adoption and impact. While there are multiple reasons for this, including data availability and legacy systems, a key challenge has been the difficulty of convincing stakeholders about the accuracy, trustworthiness and relevance of AI model outputs.

To the extent that insurers’ technology platforms can make use of AI functionality, which they increasingly do, I know the importance of being confident that such AI models’ predictive powers are fully understood, where any possible limitations or biases in the data and/ or models are identified and then resolved; TruEra is particularly well positioned to help data analytics and actuarial teams in doing so and ensuring that the AI models can be trusted. So, I am delighted to have become a senior advisor at TruEra and be part of the company’s journey, helping insurers gain that confidence in their AI models.

AI holds great promise for insurers

Understanding underwriting and pricing risk in insurance has always been dependent on analysing historical data, such as those on mortality or P&C loss records. In this sense, actuaries can perhaps be seen as precursors to modern-day data scientists.

Two major changes are turbo-charging the AI opportunity:

- First, there is an explosion in the data available to support decision-making. Some of this, such as the detailed information filed to regulators by publicly listed companies, was always available as unstructured documents, but recent advances in extracting structured data from such documents have made them much more accessible. Other types of data, such as satellite imagery, have simply become more widely available. Finally, altogether new categories of data have arisen in some cases – such as personal health data originating from wearable devices or ‘machine health’ data originating from Internet of Things (IoT) networks.

- Second, the maturity of AI techniques has increased dramatically in the last few years. Computing power and data storage has become substantially cheaper. All this has enabled insurers to build meaningful predictive models using the massive amounts of data they can now access.

As a result, a rich set of opportunities have opened up to use data and advanced modelling techniques more effectively. AI models can now be used to supplement or even replace traditional models for underwriting and pricing of risk, automate several aspects of claims management and associated fraud assessment, and automate parts of customer service and back-office operations.

Business impact of AI remains largely sub-scale

However, at many traditional insurers, enthusiastic experimentation with AI has not yet translated into large-scale adoption, and the business impact remains muted compared to its potential.

There are many reasons for this, such as a lack of quality data or the difficulty of integrating with legacy systems. But a critical stumbling block has been the difficulty of convincing stakeholders about the accuracy, trustworthiness and relevance of AI model outputs. Two factors are driving this lack of trustworthiness:

- The workings of many AI models are far more opaque than traditional models.

The most common type of AI algorithms (Machine Learning) creates models based on the data used to train them. As a result, the data scientist’s understanding of how the model actually arrives at its conclusions can be limited. This poses a challenge in convincing stakeholders – business line owners, risk and compliance teams, auditors, regulators and customers – about their suitability for large scale use. - AI models’ dependence on the training data can make them prone to particular weaknesses.

Compared to traditional models, AI models are more likely to ‘overfit’ or exaggerate historical trends. They may lose their predictive accuracy more easily in the face of changes in input data, such as those triggered by, for example, the pandemic. Finally, they can exacerbate existing biases present in the training data, such as biases regarding gender or race.

So how can insurers overcome these obstacles and realize the full value of AI?

TruEra’s AI Quality solutions specifically address the barriers to AI success at insurers. Specific uses of TruEra’s solutions include:

- Proving or improving model accuracy

- extracting automatically features from more complex models such as gradient boosted models in order to improve the accuracy and quality of less complex logistic regression models

- Increasing trustworthiness by explaining model behavior

- explaining accurately a model by identifying features driving its behaviour

- analysing whether the model could lead to unfair treatment of customers, and if so, understanding what factors drove the bias

- Demonstrating the relevance of AI outputs

- assessing conceptual soundness (i.e., allowing subject matter experts to identify areas in which the model’s predictions/ outcomes do not make sense in practice)

- identifying predictions or recommendations with lower reliability due to over-dependence on a small number of input variables

- Rooting out training data quality issues

- Identifying where results are impacted by unusual aspects of the training data

TruEra has worked with insurers on several of these use cases, in areas such as pricing/ discounts and underwriting support.

By using these solutions, insurers will have a better understanding of their AI models. This, in turn, will give them (and their key stakeholders), greater confidence in those models. That confidence will enable them to shift their AI model use from development into full production, so that they can achieve the full value from their advanced modelling efforts in this space.

For more information: AI Quality solutions for insurance